Introduction to Gomyfinance.com Create Budget

Are you tired of living paycheck to paycheck? Do unexpected expenses leave you feeling stressed about your finances? If so, it’s time to take control and create a budget that works for you. Enter Gomyfinance.com Create Budget—your go-to platform for simplifying budgeting and making sense of your money. With user-friendly tools and resources, managing your personal finances has never been easier. Whether you’re saving for a dream vacation or just trying to stay afloat, understanding how to effectively budget can change everything. Let’s dive into the step-by-step guide on how Gomyfinance.com can help you master the art of budgeting and achieve financial freedom!

Benefits of Creating a Budget with Gomyfinance.com

Creating a budget with Gomyfinance.com brings clarity to your financial landscape. You gain control over your spending and savings, leading to informed decisions.

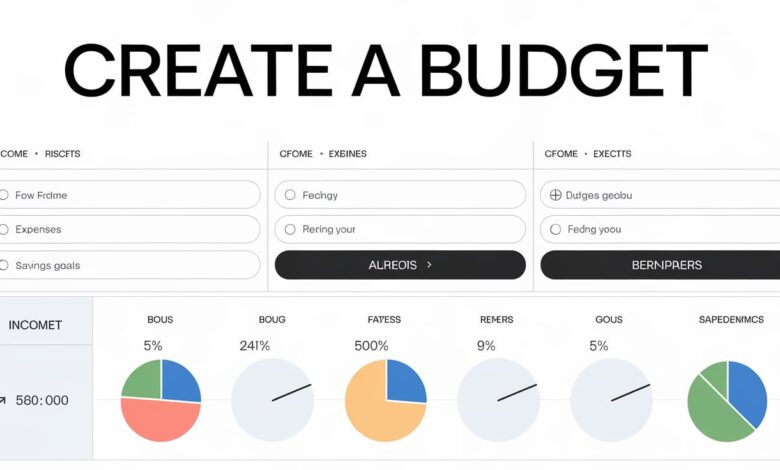

One significant benefit is the user-friendly interface that simplifies tracking your finances. It allows you to visualize where your money goes every month.

Additionally, Gomyfinance.com offers real-time updates on income and expenses. This instant feedback helps identify areas for improvement quickly.

The platform fosters accountability by allowing you to set specific goals. Whether saving for a vacation or paying off debt, having clear objectives keeps you motivated.

With customizable categories, budgeting becomes more intuitive. You can tailor it according to personal priorities, making financial management less daunting.

Using Gomyfinance.com promotes smarter spending habits over time. As you become more in tune with your finances, achieving financial stability becomes an attainable goal.

Step 1: Set Financial Goals

Setting financial goals is the crucial first step towards effective budgeting. It gives your finances direction and purpose. Without clear objectives, it’s easy to drift aimlessly.

Begin by identifying what you want to achieve in both the short and long term. Maybe it’s saving for a vacation or paying off debt. Having these targets will motivate you as you navigate your financial journey.

Make sure your goals are specific, measurable, achievable, relevant, and time-bound (SMART). For example, instead of saying “I want to save money,” specify “I will save $5,000 for a home down payment within two years.”

This clarity helps prioritize which areas need attention first. As you set these milestones with Gomyfinance.com create budget tool, you’ll find it easier to stay focused on what’s essential for achieving financial success without feeling overwhelmed.

Step 2: Track Your Income and Expenses

Tracking your income and expenses is a crucial step in creating a budget. It gives you visibility into where your money comes from and where it goes.

Start by listing all sources of income—your salary, side gigs, or any other earnings. This creates a clear picture of the resources available to you each month.

Next, keep an eye on your spending habits. Record every purchase, no matter how small. Use tools like spreadsheets or budgeting apps to make this process easier.

You might find that certain expenses are higher than expected. Identifying these areas allows for better decision-making later on.

Remember to review your transactions regularly. Consistent monitoring can highlight patterns in your spending that may need adjustments as you move forward with your budget plan.

Step 3: Categorize Your Expenses

After tracking your income and expenses, the next step is to categorize those expenses. This process helps you see where your money goes each month.

Start by identifying major categories such as housing, food, transportation, entertainment, and savings. Each category should reflect your lifestyle and spending habits.

Once you’ve established these groups, assign each expense to its corresponding category. This will allow you to pinpoint areas where you might be overspending or need adjustments.

Using tools on Gomyfinance.com can simplify this task. The platform offers visual aids like pie charts that make it easier to understand how much of your budget is allocated to different categories.

Regularly reviewing these categories keeps you informed about your financial health. Adjust them as needed based on changes in income or priorities for a more accurate reflection of your spending patterns.

Step 4: Create a Realistic Plan

Creating a realistic plan is where the magic happens. It’s time to bring your goals and numbers together in a way that feels attainable.

Start by allocating specific amounts to each expense category based on your tracked data. Be honest with yourself; if you know you spend more on dining out, adjust that figure accordingly.

Consider unexpected expenses too. Set aside a small buffer for emergencies or spontaneous purchases. This cushion will help keep your budget intact when life throws surprises at you.

Ensure that your budget reflects both fixed costs and variable spending. Fixed costs are easy to plan for, but flexible categories like entertainment require thoughtful consideration.

Remember that this plan can evolve over time. Regularly revisiting it allows room for adjustments as circumstances change or new priorities emerge. Adaptability is key to maintaining financial health without feeling restricted.

Step 5: Monitor and Adjust Your Budget

Monitoring your budget is crucial for staying on track. Regularly reviewing your finances helps you identify any discrepancies or areas where you may be overspending.

Set aside time each month to go through your financial records. Compare your actual spending against what you planned. This will provide insight into how well you’re sticking to your budget.

If something isn’t working, don’t hesitate to adjust it. Life changes and so do expenses. You might discover that certain categories need more funding while others can be trimmed down.

Use tools available at Gomyfinance.com for real-time updates on your financial situation. These features make it easier to adapt swiftly when needed, ensuring you remain aligned with your goals without feeling restricted by an outdated plan.

Being flexible with your budget allows room for unexpected events or opportunities that come up along the way. Embrace this process as part of managing a healthy financial life.

Tips for Sticking to Your Budget

Sticking to your budget can be challenging, but with the right strategies, it becomes much easier. Start by reviewing your budget regularly. This helps you stay mindful of your spending habits and keeps financial goals fresh in your mind.

Another effective tip is to use cash for discretionary spending. Withdraw a set amount each week for entertainment or dining out. Once that cash runs out, you’ll think twice before splurging again.

Incorporate small rewards as motivation when reaching milestones within your budget. Celebrate achievements without breaking the bank.

Additionally, consider utilizing budgeting apps like Gomyfinance.com to track expenses seamlessly. These tools provide real-time insights into where your money goes, making it simpler to adjust accordingly.

Surround yourself with supportive individuals who understand your financial goals. Share experiences and tips; accountability can significantly improve adherence to a budget plan.

Conclusion

Creating a budget with Gomyfinance.com opens up new avenues for financial clarity. It empowers you to make informed decisions about your spending and saving.

The process involves setting clear goals, tracking your income, and understanding where every dollar goes. This level of awareness can lead to significant lifestyle improvements.

Staying committed to your budget requires ongoing adjustments. Life is unpredictable, but having a solid plan helps navigate those uncertainties.

Embrace the journey towards better financial health. With each step taken on Gomyfinance.com, you’re not just building a budget; you’re constructing a more secure future for yourself and your loved ones.

FAQs

Creating a budget can raise many questions. Here are some common inquiries about using Gomyfinance.com to craft your financial plan.

What is Gomyfinance.com?

Gomyfinance.com is an online platform designed to help users manage their finances effectively. It offers tools and resources geared toward creating, monitoring, and adjusting budgets effortlessly.

Why should I create a budget with Gomyfinance.com?

Using Gomyfinance.com allows you to visualize your income and expenses clearly. The platform simplifies the budgeting process while helping you achieve your financial goals through its user-friendly interface.

Can I track my spending in real-time?

Yes! One of the standout features of Gomyfinance.com is its ability to track expenses in real-time. This feature ensures that you stay on top of your spending habits so adjustments can be made as necessary.

How often should I review my budget?

Regular reviews are essential for effective budgeting. It’s recommended to check your budget at least once a month or more frequently if you’re making significant changes or facing unexpected expenses.

Is it difficult to get started with budgeting on this platform?

Not at all! The step-by-step guide provided by Gomyfinance.com makes it easy for anyone—regardless of experience level—to start budgeting right away. Just follow the outlined steps, and you’ll find yourself on the path to better financial health.

Can I access my budget from multiple devices?

Absolutely! Gomyfinance.com is web-based and mobile-friendly, allowing you access from any device with internet connectivity—whether it’s a smartphone, tablet, or computer.

If you’re ready to take control of your finances, exploring how gomyfinance.com creates budgets may be just what you need. Start today for a clearer picture of where your money goes each month!